Should you invest in the Stock Market or Real Estate?

I’m sure you’ve heard experts talking about how stocks have, over the long run, outperformed real estate.

However, what they do not really highlight is that the comparison is not really apples to apples.

Considering the stock market performance data – witnessing “Standard & Poor’s Bombay Stock Exchange – 500 Index”, which is a basket of stocks that gives a good overall representation of the stock market, and factoring in the dividends and inflation adjustments, the investor ultimately gets about a 7% return on their investments.

| Year | Price Change | Dividend Dist. Rate | Total Return | Inflation | Real Price Change | Real Total Returns |

| 1988 | 13.2% | 5.4% | 19.3% | 2.2% | 10.7% | 16.7% |

| 1993 | 4.4% | 3.3% | 7.8% | 2.5% | 1.8% | 5.2% |

| 1998 | 1.6% | 4.3% | 5.8% | 7.4% | -5.4% | -1.4% |

| 2003 | 12.6% | 4.6% | 17.3% | 5.1% | 7.1% | 11.6% |

| 2008 | 15.3% | 2.7% | 18.1% | 2.9% | 12.0% | 14.7% |

| 2013 | -2.7% | 1.8% | -1.0% | 2.5% | -5.1% | -3.4% |

| 2013 – 2018 | 7.2% | 3.6% | 11.0% | 3.8% | 3.3% | 7.0% |

That’s not just an assumption; Warren Buffet stated that the common range of return on investment in stocks is about 6% to 7%!

In a real scenario, a 7% return on investment is ideal!

If you successively invest in stock every 5 years, eventually over 20 years your investments would multiply to 7X. By numbers, your Rs.60 lakh of investment would reap you up to Rs.5 Cr. These numbers are drawn considering the market fluctuations (Bull Market / Bear Market) during the period of investment.

Based on the listed assumptions, if a 6% to 7% of return on the stock investment is a good option! So what about Real Estate?

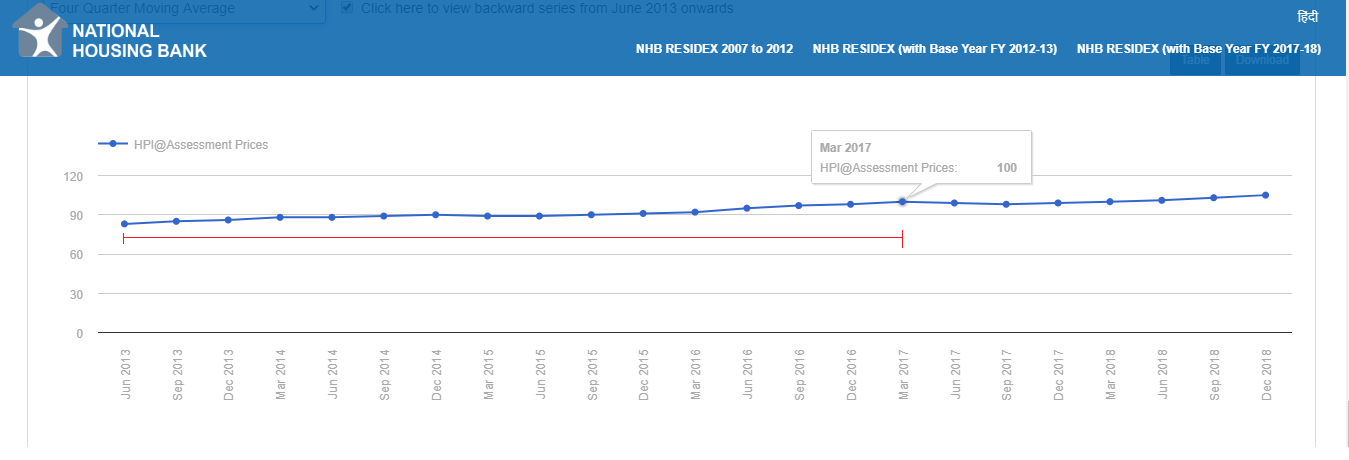

Now, for real estate, we’re going to use something called as the National Housing Bank (NHB) RESIDEX, India’s first official housing price index, undertaken at the behest of the Government of India, Ministry of Finance. Now, this index is one of the most widely accepted indices, most respected indices to track the actual housing values in the housing market in India.

Okay, so what does the indice tell us?

Well, the indice is a way for the government to track the single-unit homes, and they only include it in the indice if it’s been sold from owner to owner, having sold at least twice.

Why?

Because it’s really difficult to gauge the value of new homes added, until it’s traded between owners. So that makes the index much more accurate. There are several indices, but we’re just going to talk about the housing price index of Mumbai here.

Source: https://residex.nhbonline.org.in/

Okay! And when we look at the housing price index; the index is normalized to January of 2013, and it’s going to hundred, in 2017 March, (that is when it is normalized to 100). So everything is compared to the year 2017. So if a house sold for Rs.1 Crore in the year 2017, then in 2013 it sold for about Rs.85-87 Lakhs, okay, right there. So now this is the actual nominal values of the home prices that were sold. But, when it’s adjusted for inflation (RED Line), we see that really through 2017, from 2013 the increase is only about less than 2%. And then we factor in the drop, we see that in real terms home prices have appreciated very little over the course of 5 years here. From 2018 looking back all the way to 2013. So why should we invest in real estate?

What do we generally premise the returns on?

When invested in STOCK ![]() DIVIDENDS

DIVIDENDS

When invested in REAL ESTATE ![]() PROPERTY VALUE APPRECIATION

PROPERTY VALUE APPRECIATION

In this rational, what we tend to ignore is the return in the form of a ‘RENTAL INCOME’.

The fundamentals work similarly to that of a stock market. If you have a property well located and their market value of the location appreciates, there is a possibility of receiving higher rentals.

Plus, that ignores the impact of leverage. So when done right, when investors invest in real estate, net income, and leverage debt, investors are able to get much higher returns. Much higher than the one or 2% returns. In fact, a lot of investors are able to consistently achieve 7, 10, maybe even 12-15% returns by consistently investing in real estate by:

- Investing in the right markets,

- investing during the right times,

- using the right type of investment play

during the right market cycles. For investors that know what they’re doing, getting solid returns from real estate is absolutely doable.

Getting high returns on investment in real estate is possible; can you have a similar assurance on your stock investments?

To an extent Yes, but it’s really difficult for a common investor to get that kind of returns consistently on their stock investment as compared to what they would receive on income-generating real estate.

It’s difficult to forecast how the real estate market would be positioned in the following years, however, based on the current trend and reforms I predict that the real estate industry may see a boom by 2024. After the Budget 2019 declared under the Modi government, the country is expected to be a 5 Trillion economy in next 5 years and with the government putting the impetus on affordable housing and rural development by providing over 1.95 Cr housing to the poor, we can estimate a positive trend in the real estate industry.

It’s rumored that 90% of the billionaires and millionaires have made their money from real estate. Perhaps what they don’t know is that they preserve their finances by investing in real estate. Investment in real estate is a way to hedge against inflation.

To conclude, real estate is the best ‘Investment Asset Class’ for individuals looking to preserve their capital and also for those looking to build their wealth!

Article Credit – Harshad Mengane – REMI Faculty